Markets plunge with S&P 500 down 6% and Dow down 2,200 after China retaliates against Trump tariffs

Markets plunge with S&P 500 down 6% and Dow down 2,200 after China retaliates against Trump tariffs

NEW YORK (AP) — Wall Street’s worst crisis since COVID slammed into a higher gear Friday.

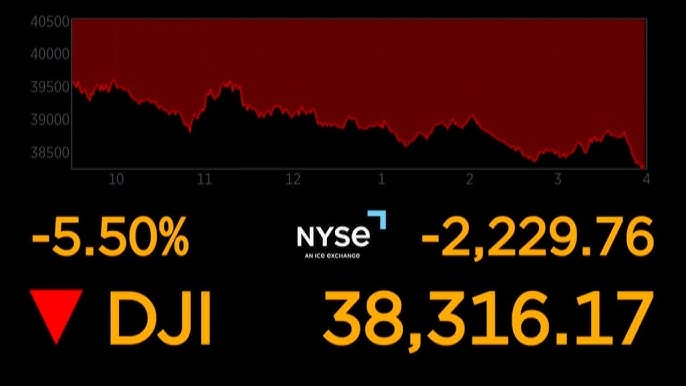

The S&P 500 lost 6% after China matched President Donald Trump’s big raise in tariffs announced earlier this week. The move increased the stakes in a trade war that could end with a recession that hurts everyone. Not even a better-than-expected report on the U.S. job market, which is usually the economic highlight of each month, was enough to stop the slide.The drop closed the worst week for the S&P 500 since March 2020, when the pandemic ripped through the global economy. The Dow Jones Industrial Average plunged 2,231 points, or 5.5% and the Nasdaq composite tumbled 5.8% to pull more than 20% below its record set in December.

So far there have been few, if any, winners in financial markets from the trade war. Stocks for all but 14 of the 500 companies within the S&P 500 index fell Friday. The price of crude oil tumbled to its lowest level since 2021. Other basic building blocks for economic growth, such as copper, also saw prices slide on worries the trade war will weaken the global economy.

China’s response to U.S. tariffs caused an immediate acceleration of losses in markets worldwide. The Commerce Ministry in Beijing said it would respond to the 34% tariffs imposed by the U.S. on imports from China with its own 34% tariff on imports of all U.S. products beginning April 10. The United States and China are the world’s two largest economies.